Get the GuestTappy app

Scan the QR code to download the app

Several Scottish councils now charge a Visitor Levy (VL) on overnight stays. Edinburgh was the first to confirm its levy, and it’s since been followed by Glasgow, Aberdeen, Stirling, and West Dunbartonshire each council can set different VL rates.

Freetobook is based in Scotland, so we have naturally implemented all the required technology to make your accommodation compliant.

If you sell accommodation in these areas, here’s what you need to know and how to calculate it correctly.

A few important rules to be aware of:

For accommodation in Edinburgh:

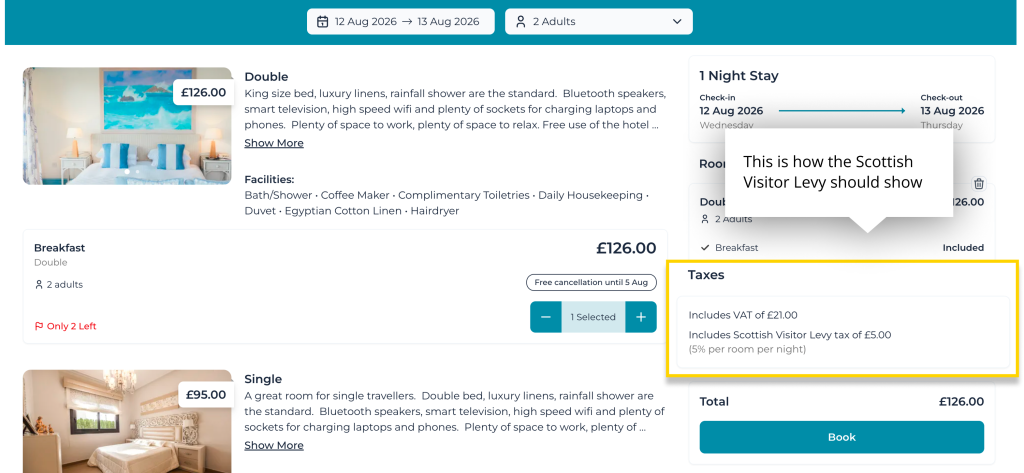

In the UK, accommodation prices are always shown including VAT. The same applies to the Visitor Levy; your price must include everything.

Let’s say the advertised room rate is £126. That £126 already includes:

Here’s how it breaks down.

Behind the scenes:

Which gives you:

That £126 is exactly what the guest sees and pays. So, how much Visitor Levy is in that £126 for VAT-registered accommodation? When everything is wrapped into one price, the Visitor Levy works out at 3.96944% of the total rate.

That £5 is what you pass on to the council.

And how do you spot the VAT in an inclusive price?

A handy rule of thumb:

So:

That £21 includes VAT on both the room and the Visitor Levy.

From the guest’s point of view, this should be simple:

This is important because accommodation must be sold at an inclusive rate.

If your advertised price is £126:

Everything is included, everything is transparent and itemised, and you’re fully compliant.

If your accommodation is not VAT-registered, the calculation is much simpler, but the same pricing rules still apply.

You still must include the Visitor Levy in the price shown to guests. The difference is that no VAT is added to either the accommodation or the levy. If your price is £120 it must have a Visitor Levy included.

Breaking that down for you:

£120 + £6 (VL) = £126

So, where you have a selling price of £126, the quick way is to take 4.761904%:

£126 x 0.0476190 = £6 which is the VL included.

Remember also that if you’re not VAT-registered, the levy still counts towards your taxable turnover. If the combined total of your accommodation charges and levy collections takes you over the VAT registration threshold (currently £90,000), you may be required to register for VAT.

This information is brought to you by freetobook; a Scottish technology company supporting accommodation providers with simple, reliable tools to help manage their businesses better.

Scan the QR code to download the app